September 2023

August 2023: Capital Markets Commentary

» Market Update

» U.S. Economic Update

» Fed Meeting in Jackson Hole

» Impact of Rising Rates

» New Asset Requirements for Banks

» U.S. Economic Update

» Fed Meeting in Jackson Hole

» Impact of Rising Rates

» New Asset Requirements for Banks

Key Takeaways

Market Update

The S&P 500 Index soared more than 18% year-to-date through the end of August. Gains from technology stocks continue to propel the performance disparity between growth and value stocks. The Russell 1000 Growth Index’s return is +32% this year, while the Russell 1000 Value Index’s is less than 6%. The performance of small and mid-cap stocks continues to be stifled by the increasing likelihood of interest rates remaining higher for longer, as both the Russell small-cap and mid-cap index have risen roughly +9%. Small and medium-sized companies typically have higher relative debt levels than larger companies, which will disproportionately provide more headwinds on their profitability relative to larger companies. The high interest rate environment also continues to pressure bond prices, as the Bloomberg U.S. Aggregate Bond Index has gained less than 2% this year.

U.S. Economic Update

According to the U.S. Bureau of Labor Statistics , annual inflation increased from 3.0% in June to 3.2% in July, missing expectations. July’s data marked the first increase after 12 consecutive monthly declines. August inflation data rose 3.7% and was also higher than expected. According to the BLS, gasoline prices increased +10.6% in August, attributing to more than half of the overall increase in inflation. The good news is that prices for most goods and services continue to trend downward.

The U.S. GDP growth rate for the second quarter was revised downward from 2.4% to 2.1%. The revision included more comprehensive data than was available in the first release and showed a decline in private inventory investment. Consumer spending and government consumption continued to increase, but at a lower rate than expected.

The August nonfarm payrolls report exceeded expectations of 170,000 and created 187,000 jobs. Additionally, the unemployment rate unexpectedly rose from 3.5 to 3.8% in August. The increase was primarily due to more job seekers entering the workforce.

The U.S. GDP growth rate for the second quarter was revised downward from 2.4% to 2.1%. The revision included more comprehensive data than was available in the first release and showed a decline in private inventory investment. Consumer spending and government consumption continued to increase, but at a lower rate than expected.

The August nonfarm payrolls report exceeded expectations of 170,000 and created 187,000 jobs. Additionally, the unemployment rate unexpectedly rose from 3.5 to 3.8% in August. The increase was primarily due to more job seekers entering the workforce.

Fed Meeting in Jackson Hole

Fed Chair Jerome Powell provided additional perspective for investors at the Jackson Hole Symposium. He stated, “It is the Fed’s job to bring inflation down to our 2 percent goal, and we will do so. We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.” While the Federal Reserve has tightened monetary policy dramatically over the past 18 months, investors are slowly accepting the expectation that rates are not likely to turn lower before next year.

Impact of Rising Rates

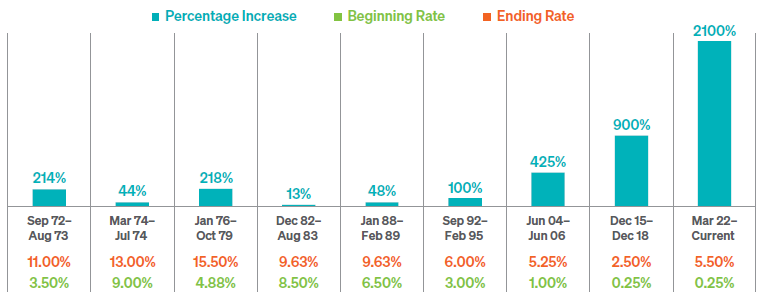

The rising interest rate environment continues to slow demand for loans. Interest rates on conforming 30-year mortgages doubled in the past year, reaching an average of 7.31% in August, reaching the highest level since 2000. Auto loan rates have also doubled. Since March 2022, the Fed has raised short-term interest rates 11 times from a target range of 0%–0.25% to 5.25%–5.50%. The short end of the yield curve rose significantly higher than the longer-dated maturities, causing the yield curve to invert. Historically, an inversion occurred before each U.S. recession going back to 1960.

The Fed’s most recent meeting minutes suggest that the committee is near the end of hiking short-term interest rates. According to CME FedWatch, at the end of August, there was a 93% likelihood that the Fed would pause interest rate increases at the September meeting. Meanwhile, the longer end of the yield curve continued to rise as the 10-year U.S. Treasury yield reached 4.3%, its highest level since 2007. Regardless of what the Fed decides on the future of interest rates, the current cycle has already made history as the largest percentage increase when comparing the change from the beginning and ending levels of interest rates.

The Fed’s most recent meeting minutes suggest that the committee is near the end of hiking short-term interest rates. According to CME FedWatch, at the end of August, there was a 93% likelihood that the Fed would pause interest rate increases at the September meeting. Meanwhile, the longer end of the yield curve continued to rise as the 10-year U.S. Treasury yield reached 4.3%, its highest level since 2007. Regardless of what the Fed decides on the future of interest rates, the current cycle has already made history as the largest percentage increase when comparing the change from the beginning and ending levels of interest rates.

FED RATE HIKE CYCLES COMPARISON

SOURCE: FOMC

New Asset Requirements for Banks

This rising rate environment has already had some casualties, most notably the four FDIC bank closures earlier this year. Historically, these types of issues are followed by increased regulation and this time is no different. U.S. regulators proposed new regulations requiring U.S. banks with $100 billion or more in assets to adhere to the same holding requirements as larger global banks. The goal of these tightened regulations is to improve the financial stability of these banks to secure the solvency of the regional banking sector. Lenders will be required to maintain debt levels that are 3.5% of their average total assets or 6% of risk-weighted assets, whichever is greater. This more stringent policy change caused three major rating agencies to update their ratings in August. These updates included downgrades and negative outlooks for some of the affected regional banks in the sector. Some regional banks already have the capital necessary to adhere to this rule, but those that do not have until July 2028 to comply with these regulations.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

©2023 Meeder Investment Management, Inc.

0116-MAM-9/15/23-37144

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

©2023 Meeder Investment Management, Inc.

0116-MAM-9/15/23-37144