Meeder Investment Portfolios

Our Investment Portfolios are constructed using Meeder Funds and combine our Growth, Defensive Equity and Fixed Income strategies, which are designed to complement one another to achieve client objectives.

Meeder’s asset allocation portfolios provide clients with access to tactically managed, diversified portfolios in a simple, turnkey solution. Clients investing in our portfolios gain access to our team of experienced portfolio managers who actively manage the underlying investments to align each portfolio with its objectives.

Strategies

Growth Strategy

The Growth Strategy is a tactical strategy that can shift exposure primarily among equity securities including sector over and underweights, international securities, and market capitalization ranges. The Aggressive Growth Strategy may invest more heavily in more volatile areas of the stock market such as international or smaller capitulation securities.

Defensive Equity Strategy

The Defensive Equity Strategy is a tactical strategy that can shift from equity securities to cash or fixed income securities when the risk/reward relationship of the stock market is deemed unfavorable.

Global Equity Strategy

The Global Equity Strategy is a tactical strategy that can shift allocations among domestic and international equities but maintains a minimum allocation to international markets at all times. The strategy also adjusts allocations to fixed income sectors.

Fixed Income Strategy

The Fixed Income Strategy is a strategy that can shift between U.S. government and agency securities, investment-grade bonds, high-yield corporate bonds, and international debt. It also incorporates duration management to maneuver between short or long duration positions.

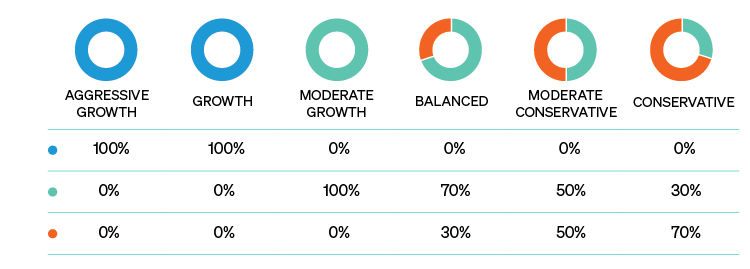

Risk-Based Portfolios

Risk-Based Portfolios allow participants to invest retirement plan assets based on their specific risk tolerance and investment objectives. As your client’s risk tolerance or investment objectives change, we partner together to update their allocation accordingly.

Age-Based Portfolios

Age-based Portfolios allow participants to invest their retirement plan assets based on their current age. Over time, Meeder will automatically move the participant’s assets to more conservative portfolios as they grow closer to retirement age.

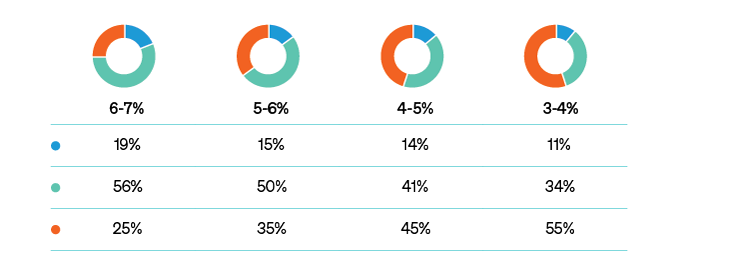

Target Withdrawal Strategy Portfolios

Target Withdrawal Portfolios are designed to help today’s retirees reach their income goals. Each portfolio is comprised of diversified mutual funds with allocations specifically designed to meet the desired target withdrawal rate.

Each Meeder Investment Portfolio is allocated exclusively among a portfolio of Meeder mutual funds designed to meet specific investment objectives and risk tolerance metrics. Portfolio allocations do not reflect the actual allocation of any individual client or account but represent the allocation of each individual model. Meeder is the investment adviser for the Meeder Funds and Meeder and its affiliates earn investment advisory, administrative, transfer agent and distribution fees for various services provided to the funds.

Meeder Investment Portfolios are typically made available through unaffiliated investment advisers that receive advisory fees or other compensation for management of the accounts. Meeder provides intermediary firms with the model portfolio but terms and conditions vary by program. Not all portfolios are available on all platforms and actual account holdings for individual clients may vary from the model. Your investment adviser can provide you with information regarding programs available at your financial intermediary.

Investment advisory services provided by Meeder Advisory Services, Inc.