July 2022

Fixed Income Commentary

The second quarter of 2022 was the second worst performing quarter in the history of the Bloomberg Aggregate Index. Learn more about how we are navigating our fixed income portfolios during this volatile time as the Fed continues to raise rates and the U.S. economy nears a potential recession.

.png?h=1198&iar=0&w=2274&rev=a3a121a768a34936862087c14535f072&hash=A3B2DEC93CB64A8C64D282597DF14581)

Key Takeaways

FIXED INCOME QUARTERLY

FIXED INCOME QUARTERLY

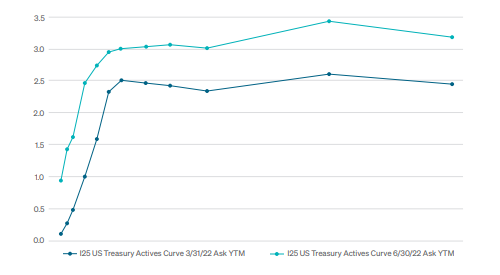

It was the worst of times…and it got worse. The second quarter of 2022 posted the second worst quarterly performance in the history of the bond market index, behind only the first quarter of 2022. The Bloomberg U.S. Aggregate Index dropped 4.69% in the second quarter after an abysmal -5.93% in the first quarter. Corporate bonds were down 7.26% while the securitized sector dropped 3.90%. No sector of the bond market escaped the negative return path, although spreads (to equivalent duration treasuries) in the high yield and lower-rated portion of the investment grade space stabilized at the end of the quarter. This was evidently created by a Fed-induced reaction to the quickly changing expectations for the path and ultimate level of the Federal Funds Overnight Rate, and the pricing of weaker growth prospects for domestic markets. The US Treasury 10-year bond started the quarter with a yield of 2.34% and ended at 3.02%, after hitting a high of 3.48%, a result of the largest increase in rate volatility in over three years. The largest one-day selloff in 10-year yields since 2008 was also an unwelcome data point, as risk contagion was bleeding into all markets. At the front end of the curve, the US 2-year Treasury note rose from 2.34% to 2.96%, with a high of 3.43% in mid-June. Clearly, uncertainty spread throughout the curve as inflationary expectations were priced in and the markets adjusted to a new interest rate environment.

US TREASURY ACTIVES CURVE

SOURCE: BLOOMBERG

The Fed began the process of getting the Fed Funds rate back to neutral in March and continued with two more step-ups in the quarter; 50 basis points on May 4 and a further 75 bps on June 15. This was the first time since 1994 that the Fed tightened policy so much at one meeting, and further testament that they view inflation as the single biggest threat to the health of the economy. With inflation running over 9% at the CPI level, and 11% at the producer level, they are pushing very hard to get future inflationary expectations down and to reduce current demand to align with the diminished level of supply that is still a concern. At the end of the quarter, market expectations pointed toward the Fed raising rates throughout the year until the Federal Funds Rate reaches the 3.25-3.50% range, double the current level.

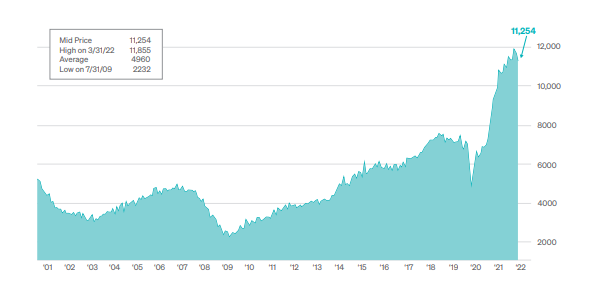

One of the surprising sources of strength in the market has been the jobs market. The unemployment rate has remained stable at 3.6%, while the Labor Force Participation rate ended the quarter around 62.2%. Interestingly, the number of available job openings has reached multi-decade highs, keeping wage pressures high and the outlook for the unemployment rate very well contained around current levels.

One of the surprising sources of strength in the market has been the jobs market. The unemployment rate has remained stable at 3.6%, while the Labor Force Participation rate ended the quarter around 62.2%. Interestingly, the number of available job openings has reached multi-decade highs, keeping wage pressures high and the outlook for the unemployment rate very well contained around current levels.

LABOR FORCE PARTICIPATION RATE

SOURCE: BUREAU OF LABOR STATISTICS, BLOOMBERG

FIXED INCOME INSIGHTS

MONEY MARKETS

» Money market product has been fighting an uphill battle over the past couple of years as a flood of cash has been parked by many counterparties seeking refuge from low yields and increased volatility. Despite the hurdle, investments in the short part of the yield curve offer attractive yields today. At the beginning of the quarter top tier commercial paper (CP) had a spread of 89 basis points over term equivalent Treasury bills. By the end of Q2 the relationship grew to 115 bps. In addition, the steepness of the money market curve moved from 150 bps to 186 bps during the same period, as measured by overnight rates out to 365 days. At the beginning of the quarter, 1-year Secured Overnight Financing Rate (SOFR) printed at a spread of the index +45 bps. By the end of the quarter for the same term, the spread to the index was +62 bps.

» As expected with all the activity in the money market arena, most participants adopted a conservative strategy. Portfolio positioning has moved extremely short with the weighted average maturity (WAM) of most money funds falling from approximately 40 days at the beginning of the year, to under 20 days by the end of the second quarter.

» As expected with all the activity in the money market arena, most participants adopted a conservative strategy. Portfolio positioning has moved extremely short with the weighted average maturity (WAM) of most money funds falling from approximately 40 days at the beginning of the year, to under 20 days by the end of the second quarter.

CORPORATE BONDS

» Investment grade corporate bond spreads increased by 0.42% to 1.56%, and yields rose by 1.10% to 4.70%. However, with the combination of higher US Treasury yields and corporate bond spreads, the total return of the investment grade corporate bond market fell by -7.26%. The total returns and excess returns were negative across each duration segment and across the credit spectrum. However, longer duration and lower credit quality segments underperformed the most in terms of both total returns and excess returns.

» With the repricing of corporate credit spreads to reflect lower growth and/or recessionary probabilities, we think opportunity remains to selectively add corporate credit exposure to portfolios. The movement in yields and spreads for certain segments of the corporate market will provide an attractive entry point for adding yields not seen in more than a decade, with limited downside risk of further spread deterioration. The challenge will be to determine when to add exposure and in which segments of the sector.

» With the repricing of corporate credit spreads to reflect lower growth and/or recessionary probabilities, we think opportunity remains to selectively add corporate credit exposure to portfolios. The movement in yields and spreads for certain segments of the corporate market will provide an attractive entry point for adding yields not seen in more than a decade, with limited downside risk of further spread deterioration. The challenge will be to determine when to add exposure and in which segments of the sector.

LOOKING FORWARD

LOOKING FORWARD

We continue to believe that volatility in the fixed income markets will remain elevated throughout this Fed cycle. As rates drift higher on the front end of the curve, 5-years out to 30-year bonds could continue to increase in price as the market prices-in the odds of recession, and foreign demand for the US dollar and our bonds adds to the demand for longerduration instruments. While opportunities will present themselves for good entry points to add spread and risk to the fixed income portfolios, we are cognizant of the technical aspect of trading these anomalies and will be disciplined in our approach.

Investment grade spreads typically widen into a recessionary period as balance sheets weaken and purchasing power is lower. The Fed will continue to increase rates until they achieve a neutral level (with Fed Funds at or above the current inflation rate). That type of environment bodes well for diversifying our exposure and following a disciplined duration and spread management approach. The increase in yields is very attractive and locking in higher coupons will be part of our process as we maintain liquidity and utilize a defensive posture.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

©2022 Meeder Investment Management, Inc.

0116-MAM-7/19/22-26998

Investment grade spreads typically widen into a recessionary period as balance sheets weaken and purchasing power is lower. The Fed will continue to increase rates until they achieve a neutral level (with Fed Funds at or above the current inflation rate). That type of environment bodes well for diversifying our exposure and following a disciplined duration and spread management approach. The increase in yields is very attractive and locking in higher coupons will be part of our process as we maintain liquidity and utilize a defensive posture.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

©2022 Meeder Investment Management, Inc.

0116-MAM-7/19/22-26998