June 2025

Israel Strikes Iran

Key Takeaways

Israel conducted an early morning air assault on June 13 with over 200 Israeli jets and drones striking multiple targets across Iran, including uranium-enrichment facilities, missile production sites, and command centers. Iranian reports indicate that at least 20 senior IRGC officers and six nuclear scientists were killed, marking one of the most significant direct hits on Iran’s military infrastructure in decades.

The United States publicly distanced itself from the operation, as President Trump reiterated that Tehran “brought this on itself” by failing to curb its nuclear ambitions.

The United States publicly distanced itself from the operation, as President Trump reiterated that Tehran “brought this on itself” by failing to curb its nuclear ambitions.

Market Reactions

Financial markets reacted sharply: Brent crude oil spiked more than 9%, briefly surpassing $75 per barrel on fears of disruptions in the Strait of Hormuz, while gold neared record highs as investors sought safety. Equities sold off broadly, with airline stocks plunging on fears of spiking fuel prices and airspace closures. In fixed income, U.S. Treasury yields fell as investors moved to the safety of government bonds. It will be interesting to see what impact this oil-driven inflation could have on the Fed’s plans for interest rates.

Looking ahead, the risk of further Iranian retaliation or wider regional clashes creates uncertainty that could keep energy prices elevated. Any disruption to shipping lanes or energy infrastructure could heighten these pressures and potentially impact monetary easing by the Federal Reserve. Conversely, a diplomatic breakthrough or swift de-escalation might see markets retrace much of the recent volatility.

Looking ahead, the risk of further Iranian retaliation or wider regional clashes creates uncertainty that could keep energy prices elevated. Any disruption to shipping lanes or energy infrastructure could heighten these pressures and potentially impact monetary easing by the Federal Reserve. Conversely, a diplomatic breakthrough or swift de-escalation might see markets retrace much of the recent volatility.

What History Tells Us?

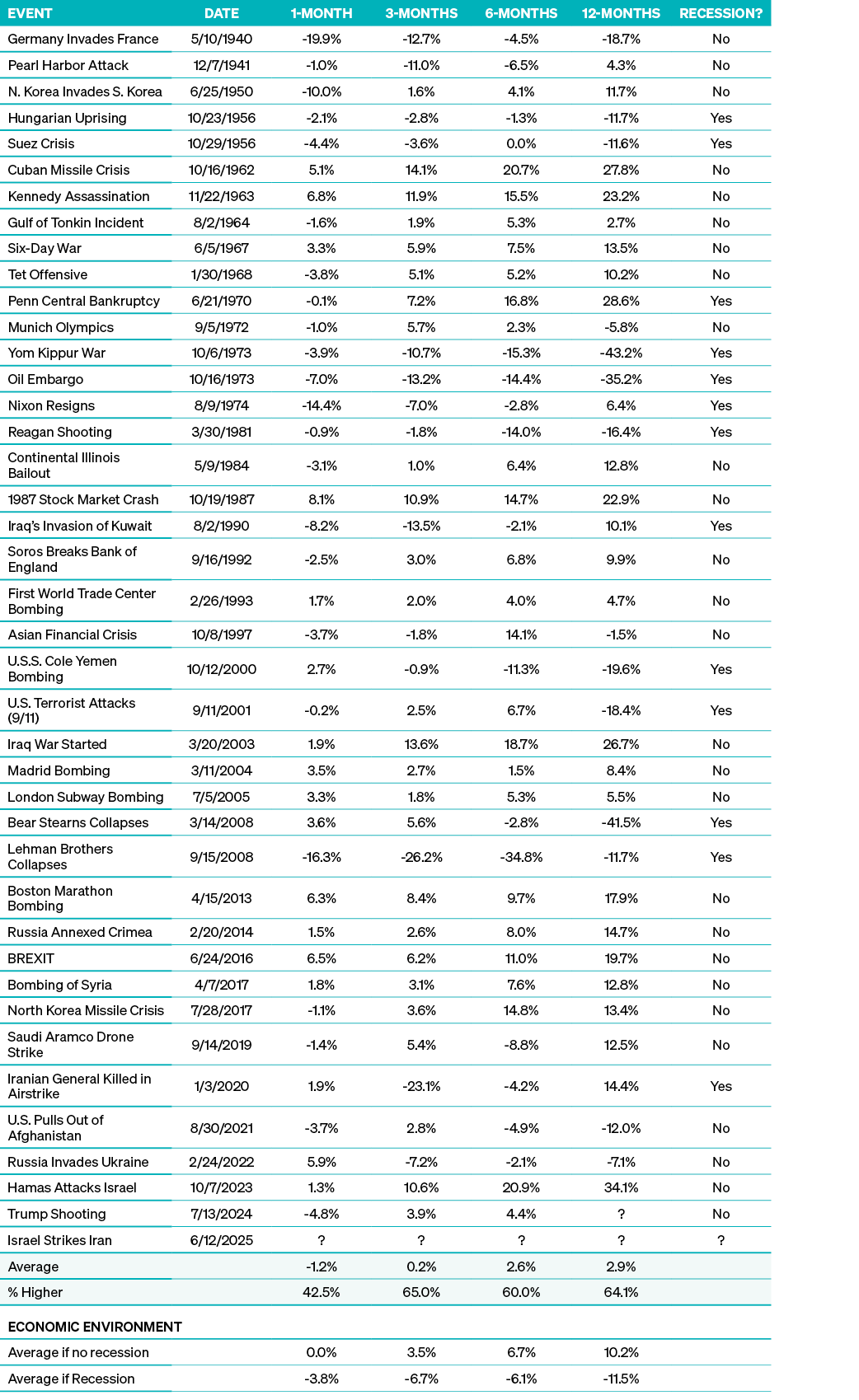

It is important to remember that each historical event is unique and does not predict the future, but it can provide an idea of what investors may expect. Below is a table of geopolitical events that have occurred going back to 1940 and the impact these have had on the performance of the S&P 500 over various time periods.

SOURCE: CARSON INVESTMENT RESEARCH, BLOOMBERG

History shows that geopolitical shocks typically provoke short-term market weakness, but gains have often followed over the medium and longer term. On average, the one-month return after these events is –1.2% (with 42.5% of events positive), yet by three months the average return is +0.2% (65% positive), by six months +2.6% (60% positive) and by twelve months +2.9% (64.1% positive). Importantly, those gains are almost entirely driven by non-recessionary periods, when economies remain on solid footing, returns are very positive, whereas events accompanied by a recession see negative trajectories. Staying invested through the noise and focusing on broader economic fundamentals has historically rewarded patience rather than panic.

Looking Ahead

While it may be uncomfortable, it is vital to remember that market volatility is common and can sometimes produce opportunities. While it is essential to have a financial plan, it is more important to maintain discipline and refrain from allowing emotion to drive investment decisions when the market becomes challenging. If you have questions or would like to continue the conversation, reach out to your regional Meeder Consultant.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicit, or recommend any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Investors cannot invest directly in an index. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.

Investment advisory services provided by Meeder Advisory Services, Inc.

©2025 Meeder Investment Management, Inc.

0289-MAS-6/16/25-51345