You are now leaving Meeder Investment Management. Links to other websites are provided for your convenience and information only. When you click on a link to another website you will be leaving this website. The fact that Meeder Investment Management provides links to other websites does not mean that we endorse, authorize or sponsor the linked website, or that we are affiliated with that website’s owners or sponsors. This material is being provided for informational purposes only and is not a solicitation or an offer to buy any security or to participate in any planning or investment strategy. Unless otherwise indicated, the linked sites are not under our control and we are not responsible for and assume no liability for the content or presentation of any linked site or any link contained in a linked site, or any changes or updates to such sites. We make no representations about the accuracy or completeness of the information contained in any linked sites and their privacy and security policies may differ from ours. We recommend that you review this third-party’s policies and terms carefully.

May 2022

Monthly Commentary: Early May 2022

Performance of the S&P 500 Index struggled in April and declined over -8%, bringing the total year-to-date decline to almost -13%. Concerns about rising inflation contributed to the selling of stocks, as those with higher multiples were especially hit hard. Investors rapidly sold their positions in these companies in favor of those with more solid fundamentals given the uncertain economic outlook.

Fed Raises Rates

CAPITAL MARKETS UPDATE

Performance of the S&P 500 Index struggled in April and declined over -8%, bringing the total year-to-date decline to almost -13%. Concerns about rising inflation contributed to the selling of stocks, as those with higher multiples were especially hit hard. Investors rapidly sold their positions in these companies in favor of those with more solid fundamentals given the uncertain economic outlook. Companies in the tech-heavy NASDAQ Composite were especially targeted, with some experiencing as much as a -40% fall. The index experienced its worst-performing quarter since 2008. On average, the guidance and outlook provided by corporations was grim and caused some to fear stagflation, which is a slowing economic environment combined with rising inflation. In April, all the S&P sectors move lower except for consumer staples, which climbed +2%. Widely held large, mid, and small-cap benchmarks for both growth and value styles also posted negative returns for the month. The 10-year U.S. Treasury yield climbed nearly 3%, as the performance of the Bloomberg U.S. Aggregate Bond Index fell more than -3% for the month and -10% year-to-date in one of the worst fixed-income environments that investors have ever experienced.

Fed Raises Rates

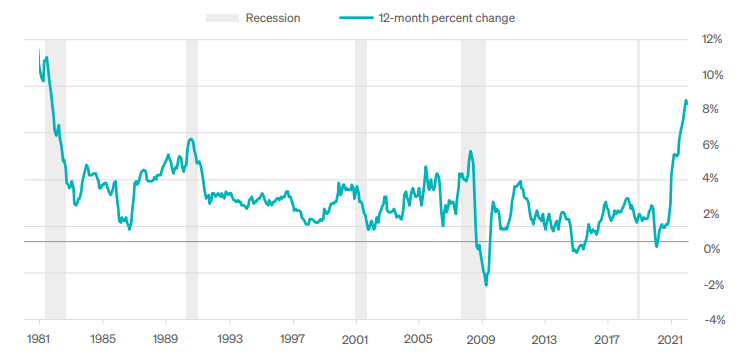

CPI INFLATION 12-MONTH PERCENT CHANGE

APRIL 2022

SOURCE: BLS

Fed Raises Rates

EMPLOYMENT SITUATION

Nonfarm payrolls added 467,000 jobs, missing the consensus estimate of 510,000 in January. The unemployment rate also rose slightly from 3.9% to 4.0%. According to the Bureau of Labor Statistics, there were 68.9 million people in the U.S. that separated from their employer in 2021. Out of this number, 47.4 million workers voluntarily quit their job. Economists are calling this event “The Great Resignation.” This has caused staffing shortages across the economy that range from the most basic to the most skilled positions in the workforce. There are now more than 10.9 million job openings in the United States. The lack of staffing has forced some factories and businesses to operate with fewer employees. Even worse, are those companies that cannot stay open during their regular business hours because they do not have the staff necessary to function. Despite all of this, productivity as measured by GDP exceeded expectations for the fourth quarter of 5.5% with a result of 6.9%.

Fed Raises Rates

FEDERAL RESERVE

The Federal Reserve got investors’ attention after providing details on their path on monetary policy. The committee stated that they are committed to containing inflation and implemented a 0.50% increase in the Federal Funds overnight lending rate at their May meeting. This raised the target range to 0.75-1.00%, which was in line with investors’ expectations. It was the largest single increase in interest rates by the Fed since May 2000. In addition, they set the expectation that it is likely there will be rate increases at each of the remaining meetings in 2022. According to Bloomberg, the market is currently pricing in the likelihood that there will also be 0.50% increases at the FOMC’s June and July meetings before the committee regroups for the remainder of their meetings in September, November, and December. Additionally, the FOMC minutes from the March meeting stated that the committee would be reducing the size of its balance sheet by up to $95 billion in assets per month. Interest rates of longer-term maturities spiked on the news.

Inflation Still Persistent

U.S. ECONOMY CONTRACTS IN FIRST QUARTER

Although economists provided consensus estimates of an expected growth rate of +1.1%, the U.S. economy sputtered during the first quarter of 2022 as GDP unexpectedly contracted by -1.4% quarter over quarter. There were two main reasons for this decline. The first surrounded a substantial reduction in gross private domestic investment growth from +36.7% to just +2.3%. This is a measure of the investment of domestic businesses within their own country. The other major factor was a reduction in the number of exports leaving the country. In the first quarter, there was a -5.9% decline in exports compared to the fourth quarter. Domestically, signs of economic strength weakened in April as the Institute of Supply Management Survey index levels declined. The ISM Manufacturing PMI index fell below estimates of 57.6 to a level of 55.4 for the month. This is down from March’s index level of 57.1. Service-oriented companies represented by the ISM Non-Manufacturing PMI index also fell short of consensus estimates of 58.5 for April, reporting an index level of 57.1. While these measures were short of expectations, they did still show expansion. Any level above 50 shows growth.

Inflation Still Persistent

LABOR SHORTAGE CONTINUES

The labor shortage in the U.S. continues to expand. In March, 205,000 additional openings were added to bring the total to 11.6 million job openings. This is the highest level since this data started being recorded in December 2000. One contributor to this shortage continues to be those that voluntarily quit their job. In March, the number of Americans that quit their job reached a total of 4.53 million. The good news is that the U.S. economy added 428,000 jobs in April, above estimates of 391,000. All employment sectors saw gains with leisure and hospitality adding the most hires.

Inflation Still Persistent

RUSSIA AND UKRAINE

The uncertainty surrounding the war between Russia and Ukraine also provides uncertainty for investors. The region’s energy and food markets are disrupting supply chains and increasing prices, adding to the already high global inflation. The economic impact of this war will take years before the full impact is determined. Ukraine continues to reach out to members of NATO for military equipment and financial support. The U.S. has provided a total of $2 billion in security assistance to Ukraine since January 2021.

HOUSING PRICES SOAR

Single-family housing prices in the U.S. climbed at a record pace of +20.2% year-over-year in February. The S&P Core Logic CaseShiller index showed that all 20 cities represented increased by double digits. This was the highest monthly increase since the inception of the index in 2000. This along with rising costs due to higher interest rates contributed to a decrease in affordability and contributed to new home sales falling in March by -8.6% month over month.

COVID-19 UPDATE

The CDC provided an updated analysis of the COVID-19 pandemic that is suggesting the U.S. is closer to achieving herd immunity. According to their new study, 58% of the U.S. population now has antibodies from previously contracting the disease. This does not include anyone that has antibodies from immunotherapy or a vaccine. The omicron variant saw an unprecedented spread in January and February of 2022, increasing the percentage of the population with antibodies from just 34% in December. The data showed that the segment responsible for the biggest increase was children between ages 5 and 17, which were the most recent age group that received approval for the COVID-19 vaccine.

The views expressed herein are exclusively those of Meeder Investment Management, Inc., are not offered as investment advice, and should not be construed as a recommendation regarding the suitability of any investment product or strategy for an individual’s particular needs. Investment in securities entails risk, including loss of principal. Asset allocation and diversification do not assure a profit or protect against loss. There can be no assurance that any investment strategy will achieve its objectives, generate positive returns, or avoid losses.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Commentary offered for informational and educational purposes only. Opinions and forecasts regarding markets, securities, products, portfolios, or holdings are given as of the date provided and are subject to change at any time. No offer to sell, solicitation, or recommendation of any security or investment product is intended. Certain information and data has been supplied by unaffiliated third parties as indicated. Although Meeder believes the information is reliable, it cannot warrant the accuracy, timeliness or suitability of the information or materials offered by third parties.

Investment advisory services provided by Meeder Asset Management, Inc.

2022 Meeder Investment Management, Inc.

0116-MAM-5/12/22-13399